We chose upstream oil and gas industry as our research topic and examined how its business model will be affected by climate change and how should mitigation plan be.

1. Business model of oil industry

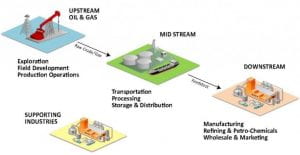

Major oil and gas companies such as Exxon Mobil, Royal Dutch Shell, BP, etc. generate values via the major three processes; Upstream, Midstream, and Downstream etc.

First, upstream involves the search for underwater and underground crude oil fields and the drilling of exploration wells and drilling into established wells to recover oil and gas. Second, midstream entails the transportation, storage, and processing of oil and gas. Resources need to be transported to a refinery, which is often in a completely different geographic region compared to the oil reserves. Third, downstream refers to the filtering of the raw materials obtained during the upstream phase. This means refining crude oil and purifying natural gas. The products are distributed to end users in numerous forms such as natural gas, diesel oil, petrol, gasoline, lubricants, kerosene, asphalt, heating oil, LPG, etc.

Major oil and gas companies purchase the right to extract resources for certain periods of time from governments which own the rights over territories and their resources. After exploration, companies invest labor, facilities, technology, logistic system, safety measures, etc. to efficiently and safely drill and extract resources. Once they acquire the crude oil, they process it to the end-products in various forms and sell them to other entities.

2. Impacts on business

(1) Increase of operating costs

Climate change increases the operating costs of the companies. The drilling part is comprised of various activities such as logistics support, crew support, supply support etc., which are affected hugely by climate changes. Global warming can affect sea levels, coastlines, ocean currents, sea surface temperatures, tides, and trigger several changes in ocean bio-geochemistry, which all requires companies’ extra costs to meet the changes. The increase of operating costs lead to the surge of oil price, and prices of end-products, which makes the worldwide economy affected negatively.

Oil and gas also consume product from mining industry which is to some degree effect by climate change. For example, barite, one of raw material used in oil and gas industry (up to 80% consumption of barite is in oil and gas industry) is effect by unpredicted flooding, making it more difficult to plan and extract which lead to increase in price.

(2) Increase of business risks

Governments want to slow down global warming, and regulations on fossil fuels are likely to increase, threatening the lucrative oil, gas, and coal industries. The overall business risk in the energy industry increases as regulations become stricter. Or in the worst case, government might choose to discontinue the right to operate and give the right to national companies.

Business risk also increase due to increase in severity and volatility of natural disaster. This poses risk to the limit of equipment, infrastructure, or the crew. And Oil and gas is usually faced with high impact but low probability risk, where one incident could mean the downfall of the company (e.g. In the event of BP’s oil spill, deep-water horizon rig. The initial response was launch a week after the deep-water horizon sink as it initially thought there is not leak, it took 3 months to stop the oil spill. It was estimated that 4.4m barrels of oil were released and total cost of the oil spill to $40bn)

(3) Deterioration of public opinions

Global warming and climate change arouse publics’ attention on environmental issues, which leads to hostile or negative attitudes toward the oil & gas industry. Many activists would think that drilling and operations of oil and gas company damages the local environment, which again might link to the general environmental issues and climate abnormality.

3. Mitigation

(1) Work closely with government and the public

It is true that most oil and gas companies are already working closely with the government to get the right to operate and favorable regulation. But with increase in climate change and pressure from citizens, it is more crucial to educate government and public to understand the tradeoff of each action and become active in proposing registration.

Proactive initiatives in environment projects to sustain relationship with the public are crucial. Upstream industry can also explore unique relationship to local villages where they employ local labor as usually these companies are employing at higher salary than normal rates.

(2) Develop collaborative partnership with mining and marine transportation industry

Mining and marine transportation industries provide critical support to upstream oil and gas industry and these industries are also facing problem from change in climate.

In Mining, supply can be effect by flood, change in climates, change in water reservoir or even change in regulation. Normally a mine is located and expected to operate in single location for a long period of time, most equipment are design specifically for certain environment.

In Marine transportation, efficiency and cost can be effect by unpredicted sea condition, change in sea route, unpredicted natural disaster. Sea vessels usually take long time to build which make it less adaptable.

Aligning incentive across these industries is crucial to enable collaboration and to allow value creating efforts.

(3) Centralized and co-develop oil spill response and emergency abandonment operation.

In the event of BP’s oil spill, damage could be mitigating if there were more initial resource in assessing the impact and launch counter measure. To minimize the cost, having oil spill response company that can also initiate assessing and controlling operation could help any company in that region to control damage in extreme events.

From my point of view, this type of companies should change radically their business model rather than trying to implement short-sighted initiatives that are not sustainable in the long-term. They should start engaging in renewable energies research and production if not currently doing so and completely change their focus if they want to ensure survival and better PR.

Thanks for this interesting article! As mentioned above, it is very important for Oil&Gas companies to invest in reducing the likelihood of a major incident and to have the required resources to mitigate its effect. However, this article does not address how to reduce the environmental impact during normal exploration and extraction operations. Environmental innovations are crucial to creating synergies between sustainability and

competitiveness towards a greener economy and the major Oil&Gas players are best positioned to open the path and make a positive impact!

Unlike other industries, players in the fossil fuels have a hard time to “green wash” itself due to its fundamental business model. Even when many institutional investor and activism investors have restrained from investing in fossil fuels companies, my guess is that they will probably still be doing quite well in the years until the renewable energy can pose itself as a serious substitute

Thanks for the article! I agree with some other commenters that the oil and gas industry needs to majorly overhaul their business model in the future – not only to save themselves but to save the planet. At one point, we’ll be out of oil and gas. In my opinion, in addition to mitigating the impact of climate change on the industry now through collaborating with governments for example, O&G companies will need to shift their attention from, well, oil and gas to renewables. Although relatively R&D spending is still limited, we are starting to see some O&G companies such as Shell starting to make this shift; investing in the broader energy landscape incl. utilities, battery providers and renewable energy sources, in addition to their existing spending on O&G R&D.