A post by Guillaume Valla, Mary Egan, Peter Nakitare and Alejandro Guil de la Vega

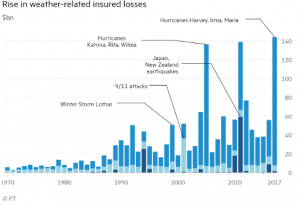

In the past, when the weatherman forecasts sun when there is rain, one might have ended up a little wet. But now, when along with rain, there is a flood, you could see your house washed away. The impact of extreme weather events related to climate change has been visibly exacerbated over the last two decades. While the weather channel’s forecasting errors don’t have a significant impact on their business, insurance risks losing billions with an incorrect guess on the weather. For an industry based on generating profits from accurate forecasting of tail-end (unlikely) events, the risks related to climate change could up-end the entire business model.

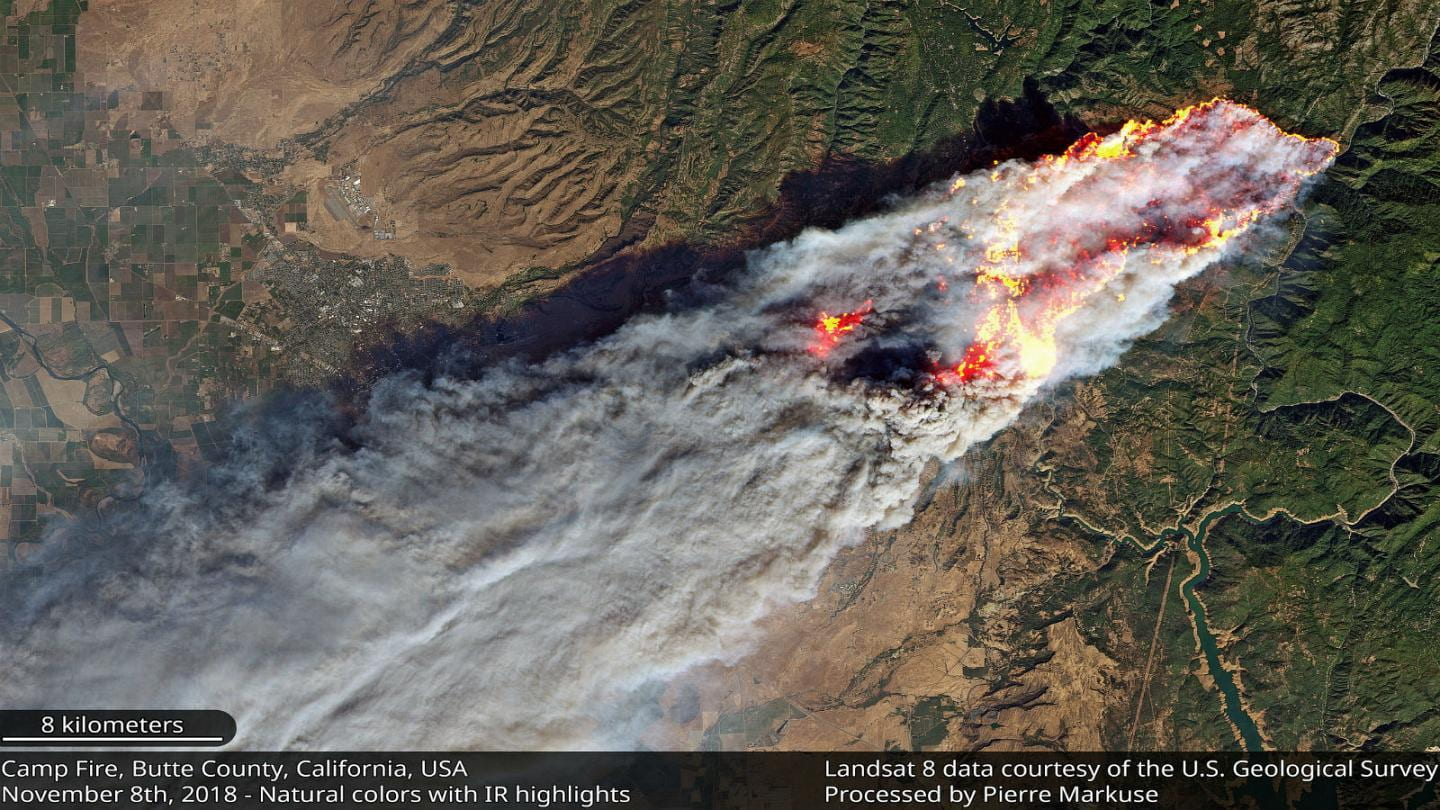

Extreme weather events have created record losses for insurance companies. In 2005, Hurricane Katrina caused over $125bn in damages to the city of New Orleans and the surrounding areas. Within two months, two additional hurricanes hit the Gulf of Mexico. Record loss-making droughts have impacted agricultural activity globally. Demographic shifts magnify these extreme events to urban centers and coastal areas. Recently, the Australia and California wildfires added to the increasing trend of weather-related claims to insurers.

In cities such as London, real estate margins for construction along the River Thames have been hurt as developers need to upgrade defenses against rising tide levels. Further regulation protecting businesses and individuals from the impacts of climate change would require upgrading infrastructure, of which part of the costs would be passed on to insurers. How can insurance companies adjust their business models and practices to avoid passing on to their customers? Furthermore, could the insurance companies alter their asset management strategies to reduce their exposure to extreme events?

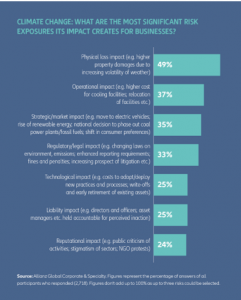

Allianz is one firm that has put a magnifying glass on the research behind understanding climate change. The Allianz Climate Risk Research Awards highlights the numerous scientists providing in-depth assessments of climate impact. This research explores topics including the exposure of coastal areas to flooding, adjusting insurance models for drought events, and simulating economic destruction from extreme storms. Moreover, experts globally are canvased for a broad assessment of risk exposure. The Allianz Risk Barometer, which asks experts to rate risks around climate change and the increased volatility of weather, illuminates the rising climate risk sentiment within the firm and external stakeholders such as regulators, industry, and investors.

The insurance industry is known to be conservative and reluctant to change. Delving into the unknown represents an unquantifiable risk which all major players, except Lloyds of London, have refused to insure. However, the industry, threatened by significant structural risks, has begun to innovate.

The insurance market is now reacting to climate change. However, significant risks exist to its traditional business model, and forecasting the impact of these risks is becoming ever more difficult. Some of the more innovative players are looking into new solutions that may allow them to participate in the tracking of climate change. Multiple start-ups are sprouting and growing through the sale of advanced analysis algorithms, which identify natural developments and track minuscule changes. Satellite and drone imagery provide accurate information on risk and claim associated events. This information allows insurers to quantify developments and risks rapidly; and better prepare themselves in the short term for spikes in claims. These algorithms also enable insurers to track larger-scale changes such as forecast agricultural yields through imagery, which enhances the industry’s ability to price agricultural insurance accurately.

DJI Image tracking California fire impact on a campsite

Refining insurance risk models using imagery and analysis of abundant data will give insurers an edge in allowing them to anticipate market developments while offering compelling products to customers.

As the world’s largest insurance company, Allianz generated €142bn in revenue in 2019 from insurance covering property, casualty, health, and business risks. Profitability is dependent on the accuracy of the risk models used to price policies adequately. Property and casualty insurance contribute 41% to profits while Life and Health insurance contribute 38% to them. The insurer manages over 2.3 trillion euros in assets, and where these trillions of euros are invested has a significant impact on the business’s performance.

Allianz has begun to align its business objectives with the UN Sustainable Development Goals. As part of Allianz’s advancement of SDG 7 (Affordable and Clean Energy) and SDG 13 (Climate Action), the company has been divesting and disassociating from climate-harmful and at-risk industries. For example, it refuses to provide insurance products to the coal industry. The company has committed to reducing its investment portfolios to net-zero carbon emissions by 2050, which represents an immense shift in investment towards sustainable assets.

Multiple players are now looking into their asset management divisions and turning toward ESG friendly assets. A significant source of profit for insurers is to manage policy premium funds ahead of large cycles of pay-outs. Allianz generates over 20% of its earnings from its asset management division despite only providing 5% of its revenue. If Allianz were to invest only in high ranking ESG friendly assets, it could act on climate change while delivering an appealing offer for its ever more conscious customers. Furthermore, studies have shown that the most ESG friendly assets have delivered up to 40% higher returns than those least conscious about the environment.

Allianz has shown itself to be a leader in the movement against climate change. Its shifts in investment philosophies and clear-eyed assessments of the risks associated with the changing climate. As an industry with the highest exposure to the mounting impacts of climate change across all sectors and regions, they are at the forefront of confronting and adjusting their business models to acclimate to the changing climate.

The coming decades will be a defining time for humankind and a re-defining one for the insurance industry.

Thank you very much for the interesting read! Thanks to this post, now I understand that the insurance sector’s investments toward ESG-friendly assets are not because it is a trend, but rather because climate change has a significantly negative impact on insurance.

I hope their efforts to understand the climate risks will be in collaboration with other initiatives such as Microsoft’s Planetary Computer which is trying ambitiously to know how the planet is functioning. More data and more analysis should be better.