The Cow in the Room – How your Steak Tartare is Fuelling Climate Change

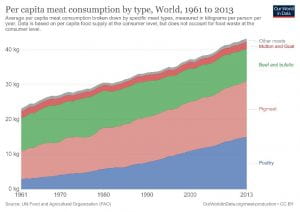

As climate change becomes a focal issue for humanity, increasing scrutiny has been heaped unto the livestock sector – a sector which over the past few decades has ballooned as populations grow and grow richer, incorporating more meat into their diets.

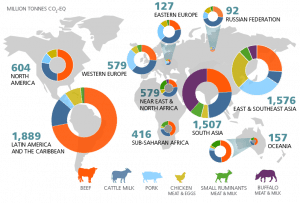

In terms of CO2 emissions, livestock rearing accounts for almost 50% of total emissions, representing 14.5-18% of human-induced greenhouse gas emissions. Of these emissions, cattle rearing for beef and dairy production constitute the lion’s share, 62%, of total livestock emissions – driven by the high energy intensity of cattle rearing, as well as high methane production by cows (http://www.fao.org/gleam/results/en/).

The effect on the environment by livestock rearing is by no means only restricted to CO2 emissions, with this activity touching on other environmental issues, including land usage, water usage, deforestation, pollution, and biodiversity.

From Jungle to Savannah – How Livestock Rearing is Transforming Nature

Globally, the livestock sector is the largest user of land resources, with 80% of all agricultural land dedicated to livestock rearing. In the US, it is estimated that 56m acres of land are used for livestock rearing compared to a measly 4m acres for growing plants for human consumption. In South America, the world-leading producer of beef, the sector’s demand for land resources has led to the deforestation of 15% of the Amazon rainforest (https://www.vox.com/science-and-health/2019/11/18/20970604/amazon-rainforest-2019-brazil-burning-deforestation-bolsonaro), 80% of this cleared land (~900ksqm) (http://www.fao.org/3/xii/0568-b1.html) to make way for pastures for livestock rearing. These transformative actions were brought to light last year when fires set to clear land for livestock rearing grew out of control leading to the deadly 2019 Amazon fires that burned down 9,060km2 (https://www.cbsnews.com/news/amazon-wildfires-brazil-spurns-20-million-aid-offer-from-g-7-nations-today-2019-08-27/).

Insatiable Thirst – Livestock’s Effect on Water Resources

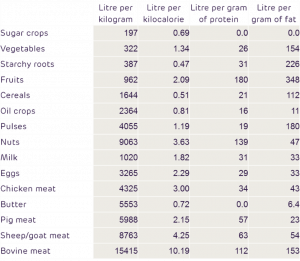

Another unintended effect of the growth of livestock rearing is how much pressure it is putting on our freshwater resources. Compared to most crops, animals require much more water resources per kilogram, with beef requiring up to 6 times more water per gram of protein than pulses ( Mekonnen and Hoekstra (2010)).

Livestock rearing may also be making your water dirtier as animal excretion, bacteria, hormones, and pesticides, all harmful by-products of this activity, seep into our water supply and pollute it.

One more factor that contributes to the current crisis is people’s eating habits. The average per capita consumption of meat has been steadily increasing and is almost double the amount we consumed 60 years ago, a trend that if continued will further aggravate global warning dynamics.

The Saviour in a Lab Coat – How Beyond Meat & Others want to Combat Climate Through Changing our Relationship to Food

“I think of meat in terms of being amino acids, lipids, trace minerals, place vitamins, and predominantly water, just like you and me. All of those are available outside of the animal,” – Ethan Brown, Beyond Meat founder and CEO[iii] (cnn.com/2019/08/22/)

A potential or at least partial solution to the crisis of global warming came out of the laboratory as a result of revolutionary thinking some 10-15 years ago – that food is a technology like any other out there, and that the one we are currently using is utterly outdated.

“Cars replaced horses, petroleum replaced whales, tractors replaced oxen, telecommunications replaced carrier pigeons…” (agfundernews.com/why-technology-could-make-animals-obsolete), it is about time, the logic goes, that we as a society upgrade protein technology and replace meat with a new, more sustainable, and less polluting alternative. The current goals of plant-based meat producers are very indeed that ambitious as illustrated by the founder of Impossible Foods, a company specialized in meat substitutes, who once declared that: “Our mission is very simple… It’s to completely replace animals as a food technology by 2035.”(cnn.com/2019/08/22/).

Meat-substitute start-ups nowadays see themselves less as food producers and more as innovators – applying the same ethos of tech companies such as Apple by heavily investing in R&D in order or churn out ever better ‘versions’ of their products in the same way ‘iPhones’ are continuously being updated.

A paradigm shift in the approach to meat-substitutes came when major players in the meat-substitute industry embarked on making the experience of eating plant-based burgers very similar to the experience of eating meat rather than just producing another veggie patty: “People are not wedded to the idea that meat has to come from animals. They’re very wired (to) the idea that they got to have the experience of eating meat…”(cnn.com/2019/08/22/). As a result, companies formed teams of scientists that would use plants – beets, potato starch, apple extract, and other ingredients – to “identify the signature aroma molecules of meat, and then source those same molecules from simple, non-GMO, plant-based ingredients.” (fastcompany.com/90202590/exclusive-inside-beyond-meats-innovative-future-food-lab). The value proposition offered by meat-substitute brands to customers is simple, enjoy all the benefits of meat – the tastes, textures, and aromas – while being healthier, cruelty-free, and environmentally friendly.

Buoyed by a mission to recreate the meat-eating experience and armed with recent innovations in food technology, such as the use of soy leghemoglobin that make vegetarian burgers ‘bleed’, Beyond Meat, Inc. (NASDAQ: BYND) entered the fold in 2009. Fast-forward more than a decade and Beyond Meat is one of the fastest-growing food companies in the United States, offering a portfolio of revolutionary plant-based meats in approximately 94,000 retail and foodservice outlets in 75 countries worldwide.

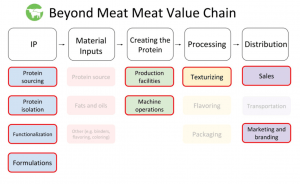

Beyond Meat’s success was, and still is, built on a business model that leverages in-house competitive advantages, such as patents on innovations and technology, constant product innovation, and a scalable and cost-effective distribution, procurement, and sales network.

Starting with the Beyond Burger, a pea-protein-based hamburger, Beyond Meat has expanded into a wide selection of faux meat products all using the same “woven” pea-protein base. The technology to make this woven protein, as well as their own product formulations, were developed in-house, although the company does cooperate with co-manufacturers to mix, flavour, and package the product. For cost and bandwidth reasons, Beyond Meat outsources to third-party logistics firms to manage distribution, although they maintain close control of their brand development and sales operations.

Dealing with Crowds – Opportunities and Challenges in the Future

The success of Beyond Meat has attracted intense competition in the global meat industry. In the conventional animal-protein industry, the historical demand for the meat has led to the evolution of a complex global business that involves farms and feedlots, middle-men in the form of transporters and logistics specialists, abattoirs, etc. The increasing production cost of meat, and corresponding decreases in profit margins for companies in this space, has made the industry vulnerable and is slowly pushing them to directly compete with bold new plant-based meat companies, bent on poaching their customers. Beyond Meat also has to contend with other plant-based protein brands such as Kroger and Aldi which have rolled out their own brands at lower prices than Beyond Meat, driven in no small part by the company’s attractive margins of around 38%(https://de.reuters.com/article/us-retailers-plant-based/grocers-roll-out-plant-based-burgers-at-prices-below-beyond-meat-idUKKBN1Z71V3).

In response to competition from both within and without the burgeoning meat-substitute industry, Beyond Meat has responded by taking more aggressive measures including launching “value packs, more aggressive pricing, and direct-to-consumer operation” (https://www.foodnavigator-usa.com/Article/2020/05/06/Beyond-Meat-to-launch-value-packs-more-aggressive-pricing-and-direct-to-consumer-operation). These initiatives come as Beyond Meat tries to close the pricing gap between its products and meat products – currently Beyond Meat burgers at Whole Foods sell for $12/pound versus $5/pound for ground beef (https://www.barrons.com/articles/beyond-meat-price-comparison-51559339044) – a gap whose closing has been expedited thanks to the COVID outbreak which has led to major supply-side disruptions in the beef industry (and thus price increase).

Beyond Meat also has to deal with another cloud on the horizon – how to maintain supply-side security in an increasingly crowded market. Most Beyond Meat products use soya as their main ingredient, which is mostly grown in the US and Brazil. Ensuring preferential access to these suppliers will be key as the market becomes more crowded and there appear transportation issues as the group opens international production facilities away from suppliers. The company also needs to make sure that ingredients are sourced in a sustainable way to avoid future disruptions to its operations.

To best way, we believe, for Beyond Meat to pre-empt and navigate future turbulence would be to do the following:

- Pursue vertical integration with suppliers. This will ensure supply-side security amid increasing demand.

Soya Bean Farm - Emphasize Intellectual Property Rights and R&D. Beyond Meat’s patented products/techniques represent the company’s largest barrier to entry for interested want-to-be entrants to the market as replicating such capabilities can only be achieved with substantial and costly investment into R&D and an arduous process of product development trial and error. Maintaining and legally enforcing these IP rights, as well as continuing to innovate and patent new processes and technologies will give Beyond Meat the double-edged advantage of having a significant barrier-to-entry for future want-to-be entrants, as well ensure customers remain infatuated with them in the same way Apple customers are infatuated with the iPhone.

If Beyond Meat implements all these steps there’s a good chance the next burger you’ll be flipping on your barbeque will look like this:

Sources:

OECD: http://www.oecd.org/agriculture/topics/water-and-agriculture/

Medium.com: https://medium.com/lean-canvas-takedown/the-future-business-of-alternative-meats-dd7d4fade63e

Robert Yaman: https://www.robertyaman.com/blog/vertical-integration-in-plant-based-and-cell-based-meat

CB Insights: https://www.cbinsights.com/research/future-of-meat-industrial-farming/

Excellent article! I am wondering whether you have considered the impact on livelihood of farmers engaging in animal husbandry rearing the livestock? Speaking from Asian context, this is almost always an incremental source of income for the farming families which will potentially be destroyed if the Beyond Meat objective is met in full resulting in a gap in their financial sustenance and security.