INVESTING IN YOU: Hybrid Model for Student Loans

By: KUNG, Nathan. SALAK, Timothy. VON FANGE, Joshua

I. Introduction

The current student loan industry tries to address concerns of social mobility, social equality, access to education, and technology innovation. While the governments of developed countries are subsidizing undergraduate education, there are other forms of education such as technical/trade schools (welding, carpentry…etc.) and Masters degrees which are generally not subsidized. For the students are approved for unsubsidized loans, the terms frequently leave students that have amazing abilities in various fields, flocking to Wall Street to get a job that can provide enough to make the US$1-2k/month payments.

Basically, the key challenge with private student loans is that interest rate increases as the risk of default increases. Students from poorer backgrounds and students going into less prestigious programs are deemed as having a higher chance of default, thus higher interest rates. This means that the rich continue to have better access to financing and the poor have less access. Since education is directly correlated to income generation potential, we have a poverty trap that needs to be broken.

The subsidized loans also have their problems. Many times these loans still have 4-6% interest rates and students don’t have strong assurance that they will be able to afford the interest payments after graduating (especially from technical skills schools). Many programs are not eligible for these loans, and international students are also not eligible. In addition, these subsidized loans are simply loans. They do not provide financial coaching nor support in making the choices which have the biggest impacts to financial success (i.e. choosing a major, choosing a trade (welding…etc.)…etc.).

At the core, they essentially shift the risk to the tax payer. As we will see later, the subsidized loan is equivalent to a convertible share where the upside is the incremental tax revenues that the government plans to receive as a result of the education. In the event that the student defaults, then we see that taxpayers as a whole suffer. This system lacks accountability, and while it has helped many, it has also failed many.

Metrics

Let’s look at some of the higher-level metrics that might be useful to track the sustainability of the industry, and then we will propose a new method that will achieve better scores along these metrics.

- Student Loan Default rates – defaulting on student loans is a recipe for financial distress for a lifetime. We want to minimize this statistic.

- Loan Repayment Rates – We want to increase this rate. Currently repayments rates are low. Over 37% of US federal student loan borrowers were unable to pay back even $1 of their outstanding principal balance after three years in repayment.

- Student Loan Application Rejection rates – We want everyone to have access to loans, and thus minimize this ratio.

II. New Business Model

The new model that we would like to propose is essentially privatizing the entire student loan market (incl. reducing subsidized government loans) and changing toward a convertible share or equity package. Ideally, we would like to mainly offer all equity-based solutions; however, initially we will start with a convertible approach to minimize our risk. In addition, we will provide access to career coaching which will help students maximize their potential (and improve our investors returns)

Our convertible solution will provide students with lower than market rates for a standard debt security (hopefully lower than government rates), in exchange for a percentage of their earnings that exceed a certain amount (region specific and loan specific) for 10 years after starting work. In the “All-equity” package, the student will have no debt payments; however, they will pay back a percentage of their earning for 10 years following their first day of work. While the % will be higher, this will reduce their risk of having debt payments in years where they end up unemployed.

These investment loans will all be pooled together for investors, which will drive down the risk of individuals defaulting or not having an ‘upside’ in the first 10 years. In addition, throughout the entire period of the investment, the students will have access to our coaches (will generally be charitable investors who want to give back). These coaches will help them with basic personal finance principles to help them make financial sound decisions, and to the best extent possible, remain independent and not advise students directly toward highest paying jobs.

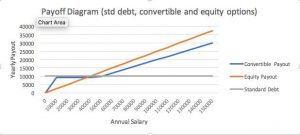

We’ve outlined the payoff curves of the traditional investments, government subsidized investments, and the new model (both equity and convertible types). While the modeling will be quite complicated, we would hope to be able to offer rates that are 3-4% lower than market rates, with an income stake (equity stake) of 25%. While this may sound like a high percentage, the unsubsidized student rate debt payments are also a significant percentage of yearly income. We would need to do further analysis which is beyond our finance capabilities to determine the exact terms for riskier technical school investments or developing/third-world investments.

The model will be self-sustainable and offer an investment class for investors which is similar to convertible debt, as well as build an alumni community that can provide resources and coaching to students.

III. Benefits of application of POM/BMI concepts

By applying the following POM concepts, this financing programme addresses the social needs:

– Make advanced or technical education accessible to everyone

– Break poverty trap through education and career support

– Allow fresh graduates to pursue career without heavy financial burden at the beginning

Aligning incentive

Fresh graduates are usually cash constraint, so they prefer to pay as little interest on the loan as possible.

Lenders care about the financial return. In the current loan business, there is a cap for the interest rate (the interest rate of the loan) that they can earn so they try their best to limit the downside risk (defaults) by implementing strict repayment policies or even require collateral.

On the other hand, our financing solution provides attractive financial return to lenders/investors based on “convertible” structure, which focuses on the “upside” potential so they can bare lower interest rate at the downside. This aligns students’ and lenders/investors’ interests both at downside and upside. At downside, students prefer to pay low interest rate, which lenders are more tolerant about. To achieve upside, lenders/investors are more willing to offer guidance or advice on the students to untap their potential, which is favourable to both parties.

Re-sequencing

The financing solution re-sequences the major repayment period to a later stage, giving students low interest rate at the beginning and potential higher repayment (as a percentage of the income) at later stage. This relieves a lot of financial burden for the fresh graduates. When they have a successful career, they can afford to repay a larger amount, which is also beneficial to the lenders who can enjoy the upside.

Risk pooling

An individual student may be risky in terms of his/her future salary. However, once we acquire a large number of students, we could predict their average future income reasonably well based on past data. Essentially we pool the individual risk together, which is more predictable as a group. Besides, we pool students from various degree majors and geographies together to reduce the concentration risk.

Intermediary

By acting as an intermediary, we not only source investments from lenders and provide funding for students, but also perform basic background check on students so that lenders are more comfortable with their investments. Financial funding aside, we provide mentorship matching for the students. Our mentors can be from our lenders or other professionals. We believe that mentoring the students can enhance their career potential and provide a better upside for the lenders.

Monitoring

Coaching – helps them, and helps increase our returns on investment. Some conflict of interest, but in general, the goal is to help them with basic personal finances, not guide them toward highest paying jobs (although personal finance models will guide them away from unsustainably low paying jobs).

Outsourcing

We plan to build partnerships with local NGOs and schools to outsource the assessment stage of the process. The students are within arm’s reach of these institutions, making them more credible and efficient in getting to know the student and building the relationship.

Matching Specific Supply(product) to Current Demand

Currently there is a surging demand for student loan, as about 70% of students have borrowed for colleges. While the demand is huge, supply is limited from private side (from banks or financing companies) and public side (from governments or tax payers). As not many students can afford collaterals, private financing companies usually charge high interest rate for unsecured debt, putting huge pressure on fresh graduates, especially when their income barely meets their expense.

In our funding programme, we look for lenders who focus on the “upside” of the students, therefore increasing the supply side. At the same time, we increase demand from students who don’t want to take loans at current high interest rate.

Apart from financial support, we also match demand and supply for our mentorship programme. Demand for mentorship is huge as students want advice and coaching for career, while many professionals or corporates are willing to support the students in this aspect.

By matching supply and demand from our financial and social perspective, we believe this can add most value to the society as a whole.

Feedback loop

Stronger financial growth will definitely boost the impact because we can fund more students. With larger student base, the return to lenders becomes more stable and attractive, attracting even more lenders and creating a virtuous circle.

In turns of social impact, by funding more students, we create a strong alumni network who will likely contribute back by providing future funding and time for mentorship. When we have more “success” stories, we can raise more funding easily.

IV.Possible Risks

Our model generally involves sharing of transfer of risk from student/borrower to lender/investor. We provide lower cost of borrowing in exchange for higher risk leading to possibility of higher returns. Below are some risks that the student and investor will face.

Student/Borrower Risks

Approval risk. There is already a huge supply and variety of student loans in the market. One key risk that students face is getting approval for these loans. Given their social status, background and geography, most students find it difficult, sometimes impossible to apply to these loans due to their lack of credibility. For our model, these are the students that we try to cater to and give access. Our model is more of a relationship base which starts prior the approval process. We plan to assess credibility by working/partnering with local NGOs/schools who have a better feel of the students in their community. Overall our approval process should be more lenient than the traditional way which is more focus on what they see on the paper application of the student. Our model invests in moldable individuals and not just purely credible ones.

Information risk. A young student is prone to such risks associated with student loans such as over-borrowing and institution risk in terms of picking the right school. These risks are shared or ultimately transferred to our model by owning this side of the process. Our platform will provide key information regarding costs and curriculum of schools. Our model is focused on student applications to technical/trade schools and masters, institutions which have high credibility.

Shared Risks

The main risk that is shared by the student and the lender/investor is the upside risk which is highly dependent on the student’s post-graduation plans. There is a risk that the job market might be in the downside and supply outweighs demand. There is also the risk that the job that the student lands will not provide enough financing to fulfil interest/equity payments. There is also the risk that the company applied to may go out of business putting the student right back to unemployment. The model can’t make these risks obsolete but it can mitigate them. Through coaching and mentoring, we will be working with the student in devising a strategic 5-10 year plan that will prepare him/her for these situations. Using our resources, we believe we will have sufficient information in addressing supply and quality of employment.

Company/Business Model Risks

Default/Repayment Risk. One of the biggest and most obvious risks in a financing type of business is repayment or default risk coming from the borrower, in this case the student. Obviously there will be written contracts involved with terms and agreement but there is still a chance that the student will not be financially capable in the future. Our model should mitigate this type of risk given that the bulk of the repayment is towards the latter stage of the borrower/student, where he should be more financially stable. Another form of mitigation would be through coaching and mentoring. Before defaulting or before this problem occurs, monitoring through coaching and mentoring should identify signals/issues and should address them before they become bigger problems that will lead to default. Information sharing should help the student efficiently manage these payments.

Financing Risk. Financing risk is an issue that the model faces at the initial stage of the business. We hope that these may be addressed through development institutions, NGOs and philanthropic individuals. The model doesn’t deal with huge fixed assets therefore investment capital shouldn’t be too large. Towards the medium term we believe that the model will become self-sustainable as more and more students avail of our product. In the long-term the company may even become profitable as the scale continues to increases.

Completion Risk. A minor risk coming from the student that the model has to deal with is risk of the student completing his/her studies or degree. We believe that this is a minor risk given that students have already gone through our assessment process, selecting driven individuals. Coaching and mentoring will further mitigate this risk as we monitor the progress of the students.

Competition Risk. As the business grows and attracts attention, there is a huge competition risk as the model may easily be duplicated. This is one of the biggest risk that we face in the long term. As the business model innovator, we believe that in the long term, we would have built enough partnerships with key institutions and shaped enough alumni that will develop a formidable network. This network will become our competitive advantage which we believe is something that is hard to duplicate once established.

This is a great model to solve the problem of student loans. There are many students in the developing countries who are not able to access higher or technical education just because they are not able to generate enough funds or secure loans. While I see a lot of merit in this model, I am also concerned about the risks that have been rightly identified in the blog. Particularly 3 things: a) where do the funds come from? if this model is to function based on philanthropists’ donations then may be as per regulations in certain countries this would have to be a not-for profit business

b) in a lot of developing countries the pay of people who are in professions such as carpentry or welding etc., is not very high and hence charging them 25% of their pay as loan repayment might throw them back in the poverty trap instead of taking them out

c) finally, I could not understand clearly how you plan to mitigate the risk of default.

May be you can try implementing the model in a developed country first or countries where regulations are clearly defined. Starting in an emerging market might be more complicated.