By Benedikt Manigold, Lucinda Robinson, Pippa Tregear

“Sustainability is achieving the right balance of economic progress, environmental care and social responsibility.”

Transportation simultaneously sits at the center of enabling economic prosperity and causing environmental damage. It is for this fact that the above definition of sustainability applies especially to this sector, and within it the subject of this post – the car manufacturing industry in Europe.

Automobiles are a source of identity and status for millions of people, and have been the epitome of freedom of movement. At the same time, few products that consumers interact with on a regular basis are the subject of more environmental debate. Cars are responsible for around 12% of total EU emissions of carbon dioxide (CO2), the main greenhouse gas, even before considering the significant emissions and resource depletions attributed to the industry’s supply chain and production processes (The European Commission, 2017). The EU automotive sector is oftentimes dubbed the backbone of the European industry, providing jobs to 12.1 million Europeans – or 5.6% of the employed population in the EU.

Any goals towards lower road transport emissions need to protect the sector’s competitiveness and jobs. Nonetheless, given ongoing technological progress, goals for the industry should be ambitious:

- Technological emission reduction: Within the coming decade, there is no reason other than economic protectionism why the total CO2 emissions of new cars should be higher than 30% of current levels – given electric vehicle adoption, improved diesel/petrol engines, and the advent of the sharing economy.

- Fleet renewal: Cars overall lifetime should be reduced, for instance by increasing utilization (currently at <4%). The currently increasing lifetime of cars translates into more older cars damage the environment.

- Car sharing: Car manufacturers’ interests need to be aligned with the positive impact of car sharing, as the benefits for the environment are significant. Parking alone adds 8-10% to journey times – and thus to emissions.

Car manufacturers must adapt to a changing consumer behavior and environmental limitations – and we propose that they should drive the change rather than wait for it to happen.

The Status Quo – Moving in the Right Direction on an old Model

One of the most regulated of Europe’s sectors, the car manufacturing industry under the umbrella of the European Automobile Manufacturers Association (ACEA) has shown willingness to drive change towards increased sustainability. To date, technical innovation has been at the heart of such change, rather than business model innovation. At an accelerating pace, the industry is now exposed to new trends including diverse mobility, autonomous driving, electrification and connectivity, all of which aid the pursuit of sustainability while presenting new business opportunities.

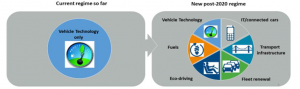

The industry is following a set of defined goals. For instance, the EU legislation sets mandatory emission reduction targets for new cars. This legislation is the cornerstone of the EU’s strategy to improve the fuel economy of cars sold on the European market. Under this framework, Europe’s automobile manufacturers are committed to mitigating the effects of climate change by “further reducing CO2 emissions from passenger cars and light commercial vehicles after 2020 within the framework of the EU 2030 energy and climate package” (ACEA, 2016). Vehicle technology has been the first step towards improved sustainability. The members of the ACEA are planning to address “non-vehicle technology” changes post 2020:

Graph 1: Initiatives for Environmental Impact reduction (Source: ACEA 2016)

According to these plans, the industry aims to focus on alternative fuels, eco-driving, IT & connected cars, intelligent transport infrastructure, and fleet renewal only after 2020.

Vehicle Technology – The Main Driver Of Emission Reduction

The EU legislation required CO2 emission rates of new cars to be below 130 g/km in 2015. The industry met this goal with average new car emissions at 123.4g CO2/km. For 2020, the EU guidelines prescribe a further reduction to 95g CO2/km (see Graph 2). These targets are among the most stringent in the world: The USA prescribe a reduction to 121g, Japan to 105g, and China to 117g CO2/km (ICCT, 2011).

Graph 2: CO2 Emission levels in the EU (Source: ACEA, 2016)

The successful reduction in the EU is a result of the sector’s continuous investments in innovation: manufacturers´ overall R&D into the reduction of emissions of their vehicles amounted to €41.5 billion in 2014. CO2 emissions from new cars will be almost 42% lower in 2021 than in 2005. However, this development is driven by regulatory pressures and is not in the industry’s best economic interest. Between 1998 and 2011, regulatory requirements increased production costs by 3-4% per year, and more recent environmental regulations are expected to add a further 16% to manufacturing costs by 2020.

The current business model of car manufacturers creates higher value from the sale of premium cars with larger, less economical engines, than from the sale of smaller, environmentally friendly cars. Hence, reduction in emissions will move as slowly as regulation allows it to, with no real incentive for manufacturers to further reduce their footprint other than brand image.

While the regulation pushes the industry in the correct direction in line with our first goal outlined earlier, the approach lacks proper long-term incentives.

Fleet Renewal – A Vital Next Step Towards Sustainability

Current CO2 legislation solely focuses on reducing emissions from new cars. Older cars are having a significant impact on the environment, which is why fleet renewal is an important task. The industry is trying to actively drive renewal rates to increase production, profitability, and environmental friendliness.

This is very much aligned with our third goal outlined earlier. As older cars are much more harmful to the environment (see Graph 1 for historical emission data) their presence on streets is a key challenge. The ACEA estimates that currently approximately 40% of all CO2 emissions of cars stem from cars built before 2005.

Graph 3: Fleet renewal rate (Source: ACEA 2016)

Fleet renewal is the most cost-efficient and quickest way in practice to reduce emissions, while stimulating consumption. If done carefully, fleet renewal could also increase the level of recycling in the industry and minimise the environmental impact of manufacturing. Cars in the EU have an average age of above 10 years, a figure that is rising year-on-year. This trend must be reversed.

The plan to boost fleet renewal falls short in practice because of the lack of ability of car manufacturers to push new models into the market. Purchasing a vehicle is a major expenditure that most private households weigh carefully. In addition, the increased quality of cars translates into longer product lifetimes at current utilization levels. While faster fleet renewal rates are in the interest of both the environment and car manufacturers, the latter have limited power to manage this (other than subsidizing new car purchases). The industry’s initiative in this regard is therefore insufficiently effective.

Car Sharing – The Endgame

Currently, the global automotive revenue pool is dominated by one-time vehicle sales, making up $2.75trn of the $3.5trn market. An additional $720bn stems from the aftermarket, while only $30bn stem from shared mobility services and including car sharing and e-hailing business models (McKinsey & Company, 2017).

In Europe, some manufacturers that are part of the ACEA have launched car sharing services such as Car2Go (Daimler) and DriveNow (BMW). These services aim to make personal mobility available to people for whom car ownership is impractical. In this market, car manufacturers are making the leap into becoming mobility service providers, offering models of their portfolio for a per-ride basis hire in urban environments in exchange for a per-mile or minute fee.

The utilization of these vehicles beats privately owned vehicles by miles. However, these services remain an added value for the car manufacturing industry, created to compete with the taxi industry and other forms of transport. As such, they will not have a significant impact on the environment. Therefore, while this trend is in line with our third sustainability goal, its repercussions for the core business are limited.

Redefining The Business Model – A Radical Vision Of Car Sharing and Fleet Management

We propose a radical and revolutionary change in the business model of automobile manufacturers towards becoming car sharing platforms with an extended fleet management role in their low and middle class segments.

This would mean shifting away from the current one-time vehicle sales model and towards a subscription-based provision of vehicles with additional fee for vehicle usage. The EU as a unified market with the ACEA as a strong association of all major European car manufacturers offers the optimal market environment for such an immense change, as all players could change their business model in sync, ensuring no benefits or disadvantages for any of the manufacturers. Manufacturers could still offer luxury vehicles on the prevalent one-time purchase basis, maintaining the freedom to sell emotionally charged experiences to those that can afford it. Lower and middle class vehicles would be predominantly produced with the goal of being managed on behalf of the customers of the manufacturers’ proprietary car sharing platform.

Customers have already decided that access to cars and other resources is more important than owning them. Possessions, perceived to be burdensome today’s younger generation, are outranked by having access to experiences – a chance for car manufacturers to innovate on changing customer behaviors.

How would this look in practice?

Car manufacturers would build out their fleet of lower and middle-class models and place these in their target markets. Customers would choose to book vehicles on a per-ride or medium-term basis in accordance with their specific need (leisure, travel, transportation, city-trips).

Graph 4: Selling experiences on a per-usage basis

Naturally, access to more expensive models would come at a higher cost, allowing for the same effect on social status that owning a more expensive car delivers. There is, however, an added element: pricing of models is influenced by demand vs. supply. A car type that is in high demand and is therefore becoming scarce will increase in price. This reflects customer willingness to pay up to a level where the customer switches brands. Car manufacturers will be able to see which type of car consumers use the most, and the characteristics that matter mostly. Within cities, fuel economy (low usage coupled to reward schemes) and size of car will be important factors. Car manufacturers are thus incentivized to produce higher numbers of these cars to cater to their target market and win or maintain segment market share. Competition between the different car manufacturers is still provided, with differentiation being as important as ever, suppressing the commoditization of cars.

Naturally, subscription to a service such as this will be economically attractive for both the manufacturers and the customer. The service will no longer compete with taxis or public transport, but with owning a car directly.

How does this address the environmental challenges?

By allowing people to own less and consume what they need, fewer resources are wasted, promoting sustainability. The sharing economy can lead to more sustainable consumption while remaining compatible with economic growth. Second to technological change to drive trains and fuels and cars overall, car sharing platforms are the simple most effective enabler of sustainability in the car industry.

According to research by ACEA (see Graph 5), CO2 emission can be reduced up to 37% by fleet renewal measures, and an additional 7-10% by “intelligent parking” applications.

| Comprehensive approach: CO2 reduction potential of various measures and applications | |

| (Autonomous) Fleet renewal | 37% |

| Intelligent parking | 7-10% reduction in distances travelled |

| Eco-driving | Up to 20% |

| Eco-navigation | Around 10% with real time eco-routing |

| Biofuels | Minimum of 8% (not including ILUC) |

| Road infrastructure | 1-2% from improved maintenance and material choice |

| In-vehicle systems (Intelligent Speed Adaptation and Adaptive Cruise Control) | 3-5% |

| CO2-based vehicle taxation | 2-4% |

Graph 5: CO2 reduction potential of various measures (Source: ACEA 2016)

Becoming the market’s main fleet managers and car sharing platforms, car manufacturers can achieve both these savings by increasing utilization rates.

Multiple researchers, including the UK National Travel Survey, estimate the typical privately owned car to be parked between 95 and 96.5% of the time with an average of 18 trips per car per week. By maximizing utilization (and therefore mileage over time) car manufacturers can replace cars faster. They gain control over the type of cars and models placed in the market and are thus able to renew the fleet at a much higher rate. This will significantly speed up the impact of technological innovation and reduce emission levels.

At the same time, the high utilization will free up available parking spaces, therefore reducing the need to look for parking spaces. Some vehicles will change hands directly without actual need for parking, as it happens already in highly frequented urban areas. The utilization thus enables not only faster renewal rates, but also unlocks the 7-10% reduction in distances traveled currently added for searching for parking.

The key challenge of current efforts to reduce CO2 footprint is the sluggish renewal rate. With the pivot in business model to predominantly producing new cars for car sharing purposes, renewal rates will be faster. By the nature of the business model, customers will pay more for newer cars, while they may save on fuel economy and win on comfort. The customer is provided with a better product and the manufacturer earns a higher revenue – all the while reducing the emissions of the fleet as a byproduct of the renewal of the fleet.

The proposed shift in business model among the manufacturers would revolutionize the way drivers “consume” cars. Demand has long begun to shift away from ownership towards access, but as of now the range of vehicles in the shared market is not attractive enough to warrant a higher price level. Only access to a full range of cars for specific needs or occasions would allow car sharing to reach the next level. Car manufacturers would drive the change rather than becoming victim of car commoditization, while aligning their business models with environmental sustainability goals.

Limitations of the Proposed Pivot

The critical point of such a revolutionary change in business model would be international collaboration. A partial adoption of the car sharing/fleet management business model by international competitors may result in distorted competition and disastrous changes in competitiveness of certain manufacturers. Protecting a pillar of their economy, states or unions may turn protectionist, reducing international trade.

Further to this, manufacturers would need to shift their business model on a market-by-market basis. The shift may be possible in Europe, yet the strategy in, for example, Asia may need to remain untouched for a while as the market dynamics are very different.

Finally, we need to assume that consumers are willing to pay a relatively high price for the usage of great cars that they do not own. Margins on current car sharing platforms are too low to justify the R&D done by the automobile industry. A full-blown car sharing ecosystem would require subscription fees more in line with entry-level leasing contracts.

Bibliography for post:

ACEA (2016). ACEA Position Paper: REDUCING CO2 EMISSIONS FROM PASSENGER CARS AND LIGHT COMMERCIAL VEHICLES POST-2020

Bertoncello, M., and Wee, D. (June 2015). Ten ways autonomous driving could redefine the automotive world, McKinsey & Company

Cohen, S. (October 2016). Urban Sustainability and the Sharing Economy, Earth Institute, Columbia University

European Comission (2017). Reducing CO2 emissions from passenger cars.

Hartmann, Dr. Udo, Daimler AG (2016). Daimler Sustainability Management & Environment@Daimler

International Council on Clean Transportation, ICCT (2011). Global Comparison of Light-Duty Vehicle Fuel Economy/GHG Emissions Standards

The Society of Motor Manufacturers and Traders SMMT (2017). 2017 UK Automotive Sustainability Report

McKinsey & Company (2016). Automotive revolution – perspective towards 2030: How the convergence of disruptive technology-driven trends could transform the auto industry