BACKGROUND: A VICIOUS CIRCLE IN BRAZIL’S HEALTHCARE SYSTEM

Healthcare in Brazil is a dreadful conundrum: the admission process in the country’s medical schools is among the most competitive in the world (with over 300 candidates per seat), and still there is a pervasive shortage of doctors. The motivating factors are many and complicated. However, although a definitive solution would take a long time to implement, closing some of the current market gaps can yield benefits in the short-term, bringing relief to the many Brazilians daily affected by the poor quality of local medical services.

Top-tier private medical schools are prohibitively expensive for most families in Brazil. Tuition fees average US$23k per year (for a six-year course), whereas the average income of less than 1% of the Brazilian population, the so-called “A class”, is US$24k per year. As a result, around 45% of private-sector students seek additional sources for funding their studies. Yet taking personal loans is particularly costly in Brazil, whose financial market is highly concentrated – with the five largest local banks accounting for 82% of the country’s credit concession and overall deposits. Interest rates average 26% per year, which is staggering in a country with a 6% base rate and a 4% inflation rate. Sadly, but predictably, defaults payments of tuition fees average 9% for medical schools, nearly 70% higher than the historical 5% observed for private education as a whole.

Government stepped in years ago offering scholarships and subsidized credit through the “ProUni” and “FIES” programs respectively. In spite of the significant investments made, results were limited from the perspective of medical school students. Availability was restricted to low income students, whose families earn less than US$9k per year, and badly aligned incentives left room for predatory price discrimination, with educational institutions charging higher prices from students who received government subsidies. Adding to that Brazil’s fragile fiscal situation, public intervention proved ineffective in the long run.

Notwithstanding, there is a supply and demand mismatch to be addressed. Successfully doing so is not only a promising business opportunity, but also a way of attaining some of the Sustainable Development Goals, such as “Good Health and Well-Being”, “Quality Education”, and “Reduced Inequalities”. The price is certainly worth chasing. The big question is how.

A PROMISING SOLUTION: AFFORDABLE LOANS FOR MEDICAL STUDENTS

Allume solves this problem by offering affordable and fair long-term loans to undergraduate and graduate students of top private medical schools in Brazil. The company enables students to achieve their dreams of becoming doctors and changing Brazilian society for the better, without having to worry about their financial lives during their studies.

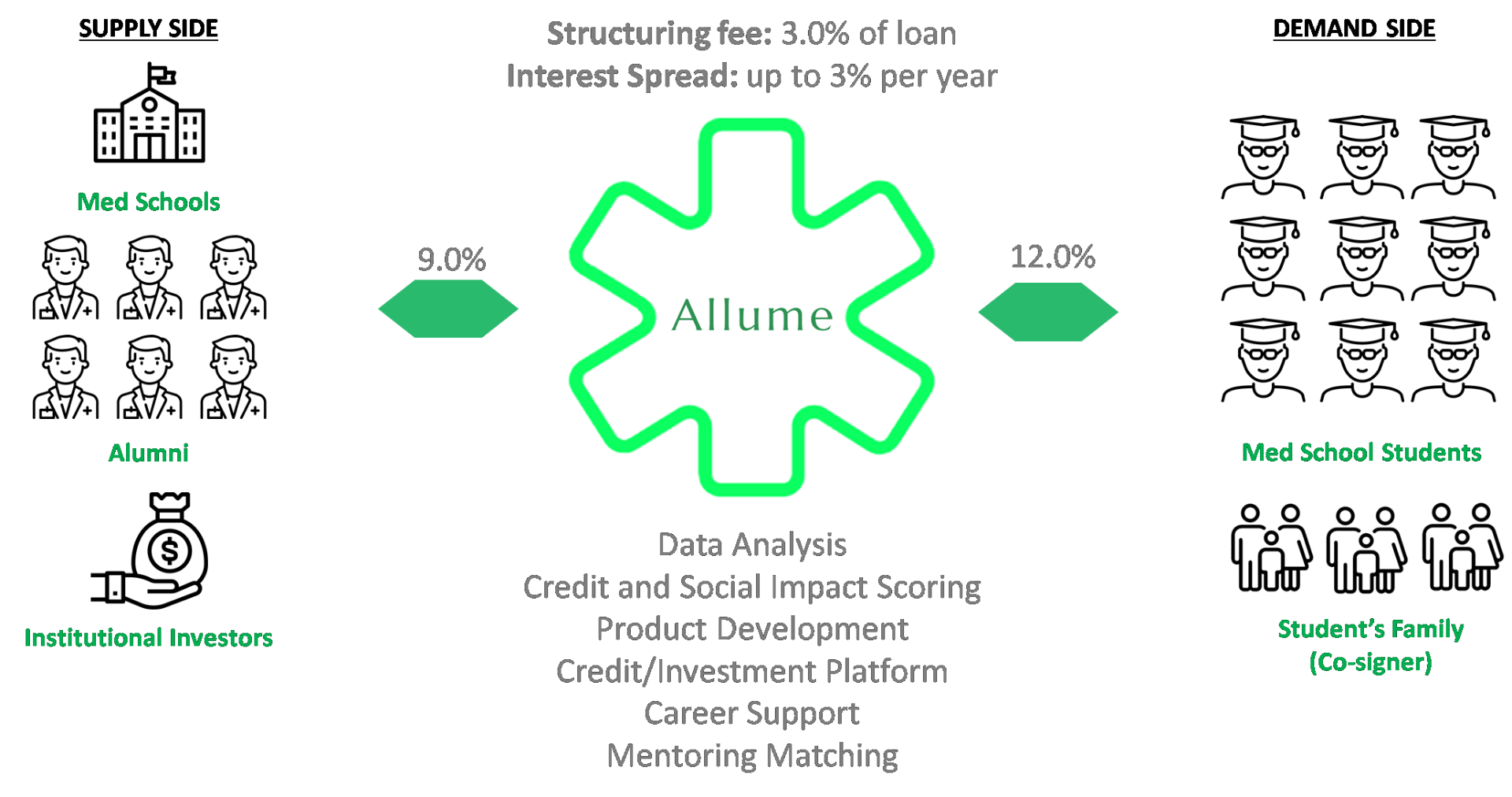

Allume works as a financial platform that relies on a network of sponsors, ranging from institutional investors to doctors and medical schools, that wish to achieve not only good financial returns but also a positive impact on the medical community.

The company raise funds from sponsors at a premium to Brazil’s base interest rate and lend to a batch of top talented medical school students that are prone for success but that face difficulties in paying tuitions, living expenses, or even paying down existing debt.

In contrast with commercial banks, who concede credit based on past historical data and wealth, Allume also considers the students’ motivation and potential of becoming a successful doctor. It charges students a 3% structuring fee, to cover operating costs, and a 3% spread on top of funding cost, which serves as a loss cushion for investors.

This loan structure offers a great value proposition for both students and investors.

Students:

- Significantly lower interest rates (12% vs. 26% per year in commercial banks)

- More time to amortize their debt (10 years duration)

- Flexible structure to fit individual needs

- Career resources (mentoring, networking & job boards)

Investors:

- Good investment return (9% vs. 6% of Brazil’s base rate)

- Mitigated risks

- Doctors have historically high earnings and low unemployment rates

- First loss guarantee (Allume will bear eventual default losses)

- Development of secondary market to provide liquidity

- Social Impact

Allume’s business model enables an exponential growth potential due to the pilling of clients and students over eight years (six-year course, plus two-year grace period) and the compounding interest effect. Therefore, even with very conservative estimates and making sure that the future value of the payments by doctors is fair and affordable (close to 30% of an average physician compensation), the company can impact over 9,200 students – generating a loan portfolio of US$530 million by 2030.

NEXT STEPS: IMPLEMENTATION PATH AND POTENTIAL RISKS

Allume management team designed a go-to-market strategy that will be done in three main phases:

1) Model Validation

2) Expansion

3) Platform Consolidation

In phases 1 and 2, Allume plans to partner with selected top medical schools to offer long-term student loans to their current and prospective students. The strategy is to grow one school at a time to test the model, learn about students’ behavior, profile and prospects, and refine the Allume Credit Score Model. In these phases, Allume will rely on referrals, word of mouth, and targeted online and offline marketing to reach partner schools and students.

In phase 3, Allume is expected to become the go-to place for medical school student loans by reaching all 140 public schools and the top 50 private schools in the country. At that point, the base of customers will allow gathering data which will enable to improve the existing offers and develop new financial services to continuously improve the financial lives of the community of doctors.

The biggest challenge of the business is securing that Allume has available funding at reasonable rates to scale in tandem with demand. Although the company also relies on doctors and medical schools to raise money and to develop its ecosystem, it still requires significant funding from institutional investors.

Also connected to the business’ funding requirements, eventual increases in Brazil’s base interest rate may decrease the attractiveness of a loan for the students due to the high pressure that such changes would impose in their future income. Under such a scenario, default rates would increase, being absorbed by Allume at first, but with the risk of impacting investors as well – in case rates exceed 20%.

Currently, there is no other player in Brazil targeting medical school students. Allume’s success may call the attention of competitors, which may try to target the company’s clients. This could lead to lower demand than currently anticipated or higher customer acquisition costs.

Some of these risks can be partly offset by partnering with banks and institutional investors that would provide better funding for growth and reduce the exposition to a competitive move from some of these actors. The interest rate and students default risks can be mitigated by expanding to other selected undergraduate courses and also by bringing Allume to other Latin American or emerging countries.

Marco Marrone | Mateus Gomez | Thiago Torres

Very interesting idea. I also see strong growth potential beyond Brazil only. Have you sensed the interest of the medical schools/alumni already, to check if they would indeed agree to such conditions?

Good and practical idea. Pooling an adequate number of medical students could be used to finance this business model and even government or institutions’ subsidies could increase the volume of available money.

Great project! I would definitely suggest to expand into other degrees or even countries in order to reduce the exposure and diversify the risk.

This is a great idea! It is especially relevant to students studying medicine due to the lengthy nature of the program, and the high expenses associated with it. I can see this expanding beyond Brazil to support aspiring Doctors in different countries.