Road transportation is one of the most polluting industries in the world. In 2018, road transportation generated 20% of the total greenhouse gas (GHG) emissions, contributing to Climate Change. Furthermore, road transportation is one of the main causes of air pollution, which is causing 3.7 million premature deaths every year. Internal combustion engines (ICE) emit NOx, SOx and other particles that not only are their GHG emissions, but in small concentration they can be very harmful, even carcinogenic, to humans. Besides, the growth of population, the concentration of population around cities, making them bigger, globalization and the growth of e-commerce are worsening the problems, making road transformation a real environmental issue to tackle.

Figure 1: GHGs emitted due to road vehicular pollution

As a result, in the last few years, the car transportation industry has experienced a huge transformation: new electric vehicles (EV) have been assigned as the solution of the majority of the environmental problems. Several major world economies have committed to transitioning to completely electric vehicles within the next two decades.

Although additional subsidy offerings by governments have accelerated the transition to EVs (more than 20% of Norway’s passenger fleet consists of EV), there are still some significant barriers impeding more widespread adoption of EVs namely the autonomy, the driving range, the charging stations and the prices associated with these cleaner means of personal transportation.

Indeed, batteries are one of the major concerns due to their production process (lack of minerals to produce them), the degradation they suffer (similar to any mobile phone battery, EV batteries degrade in storage capacity with charging and discharging cycles) and their high price.

Furthermore, EV are also justly criticized regarding their sustainability impact, especially related to the source of fuel. Even today, the majority of the electricity generated across the world is dependent upon coal, a fossil fuel with highest CO2 emissions and lowest efficiency in terms of energy transformation. Thus, there are valid concerns and expectations that EVs be powered through cleaner or preferably renewable sources of energy.

Progress is more substantial in powering the electricity grid through solar energy with more than 300 GW (~2% of total energy produced) of energy generated through solar PV cells. However, a critical limitation of using solar energy is the expense associated with storing solar energy to power consumption over the whole day.

The common device that is used to power this clean transition by storing energy is the lithium-ion battery. This is where, we believe, there is an opportunity for business innovation that can power through the rapid adoption of clean energy through the next decades.

Current business models:

At present, the batteries used in EVs are developed and purchased by EV makers. Similarly, storage batteries for solar energy storage or even back up storage are purchased by local utility companies or individual homeowners. The batteries are expensive, degrade with age and have negative socio-environmental impact in regions where the base materials for these batteries are sourced.

After their useful life, these batteries are difficult to recycle for the metals and are mostly shipped and junked in landfills across the world potentially contributing to additional land and ground water pollution and increasing CO2 emissions by transporting these batteries around the world.

To make these green technologies more sustainable, it is crucial that we reduce the waste generation by reusing these batteries for additional applications before recycling them.

New business model:

We,thus, propose that battery manufacturers such as LG Chem (supplier of batteries to General Motors, Renault, Hyundai and Volvo) lease out batteries to EV makers and charge them only on a value-basis consumption. So, if a battery pack in a Chevy Spark is used for 15% of its storage capacity, then LG Chem would only bill Chevy for consuming the 15% storage capacity in the battery. The payment structure should be set up on a periodic basis, which will ensure stable cash flows for LG Chem.

After recovering the battery pack used in the EV, Chevy should lease out the battery to secondary applications to use the remaining 85% of the battery life. Applications includes storing renewable energy, peak shaving, backup needs or even electricity trading. They can continue to charge a pay-per-consumption to these consumers as well. This approach will transfer the upfront costs associated with purchasing expensive capital equipment (the lithium ion battery) to the battery manufacturers who can recover this additional premium through government subsidies and amortizing its cost with the consumption costs.

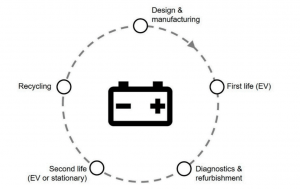

Figure 2:Circular adoption of Lithium ion batteries

This approach is beneficial to every stakeholder as it incentivizes each member of the value chain to minimize its wasteful consumption. Battery manufacturers will invest efforts in reducing costs of producing these EV batteries, by offering competitive prices, EV makers will be able to speed up their sales leading to positive ancillary effects in terms to faster adoption of charging stations, utility providers can offer incentives to individual homes with solar cells as they can store the surplus energy generation and use it to power the grid and finally battery companies will again be incentivized to develop effective recycling methods to further reassemble new batteries from old disposed ones, offering a circularity in its utilization pattern.

Additionally, imposing stiff recovery fees and penalties for batteries not returned to the battery manufacturer will address concerns regarding illegal disposal of these batteries in landfills across Africa/China.

Overall, our approach aims to increase the useful lives of the EV batteries, which makes EV more sustainable while having a positive feedback effect in the power industry, contributing to a cleaner energy.

Specifically, this business innovation will help to fulfill the following UN Sustainable Development Goals (SDG):

By re-using EV batteries for electricity storage, it will become more affordable to have decentralized electricity generation (e.g. rooftop solar PV panels), promoting clean energy. Indeed, this will also tackle the environmentalist’s concern about powering EVs with coal-generated electricity

EV will become cheaper, and overall waste will reduce thanks to a higher utilization of batteries and lower need to produce them (batteries are difficult to recycle). Besides, it will lower the cost of EV, as the salvage value of their batteries will increase. A lower price may promote their penetration which will reduce overall pollution and air quality in the cities.

Finding a second life for batteries will make production and consumption more sustainable, reducing at a certain level the resources needed to get the same output.

Both EV and more clean energy will reduce the climate impact of fossil fuels contributing to sustainability.

How does this business model outperform existing business models, both financially and environmentally/socially? Do financial growth and social/environmental impact form a feedback loop (i.e. the faster the growth, the larger the impact and vice-versa)?

We believe that this new business model is a clear example of how to make profitability while promoting sustainability. Nowadays, most of the batteries are sold in grey-markets where they are sent to Africa or China for recycling or waste disposal in Africa/China. In any case, both options are financially and environmentally sub-optimal comparing to our business model.

LG Chem will increase the salvage value of the EV batteries by leasing them to large utilities in developed countries for solar energy storage. Not only the price they will be willing to pay will be higher (increasing profitability) and reducing the barriers for adoption of EVs, but the useful life of the batteries will be larger, they will not need to travel for early disposal and they will contribute in producing more affordable and clean energy.

Additionally, since LG Chem is responsible for collecting the batteries, they are well aware of the diagnostics needed to understand the battery health having designed the battery chemistry themselves. This will protect and further incentivize battery makers to continue innovating with battery chemistries to offer best value to their customers.

In this sense, we believe that this business innovation will create positive synergies between transport and power industry, which will incredibly enhance the impact in the environment (EVs will be fueled with green energy).

Furthermore, making both EV and electricity generation technologies more affordable, LG Chem will create a positive feedback loop that will increase their penetration and growth, which will make at the same time even greater their positive impact.

Why is this a game-changing innovation?

Lithium-ion energy provides the end consumer with a whole host of advantages; much lower energy consumption, easy to handle and widely available. However, with an expensive product like this, flexible solutions are required.

So why is leasing such a good option for the electric vehicle industry? Apart from the significant benefits it brings to our environment, for the end consumer, no one wants to be stuck with a 2015 battery in 2019. The leasing model gives the customer the opportunity to keep their technology up to date, while providing the energy company growth opportunity and incentive to continue R&D.

Many electric car batteries are replaced when their capacity falls below 80%, so in fact do have quite a lot of life left in them. Therefore, they are ideal to be refurbished to store energy generated by solar power.

For a typical battery degradation cycle, the EV battery wastes energy equivalent to the section covered in blue. Better detection can improve usability of the battery in EV applications and allow for more efficient use of the battery for its second-life applications.

Additionally, using lithium batteries in second-life applications has several benefits. This extended life means additional usefulness is gained from a product that is currently rejected despite 75-80% capacity still available.

For example, Nissan has partnered with Eaton, a US power management company, to convert used EV batteries into home electricity storage units. Since they are used, they are cheaper than new units and can still hold plenty of charge. However, in 2017, only 5% of lithium-ion batteries were recycled.

This model will work ideally in a scenario where the demand for energy storage units meets the supply of used EV batteries. As it currently stands, the supply of used EV batteries is vastly outweighing the demand for second-hand energy storage units. Otherwise new inefficiencies, as outlined below, can creep up in the system

What are potential costs and risks of this innovation? What are the barriers to scaling this business model?

Despite the apparent reuse value remaining in the imminent piles of batteries, there are aspects that challenge the idea of reuse, and put barriers to scaling this business model.

Barrier 1: Adoption rate

EVs are being adopted at a much faster pace than the energy storage systems thus it can lead to a scenario where supply of batteries from EVs exceeds demand from energy storage systems leading to low prices for the second application market. This would reduce the incentives and motivation for battery manufacturers to offer a service model for their products.

Barrier 2: Technological advancements

New battery chemistries are constantly being developed and produced (such as vanadium redox batteries), energy density is improving, and Lithium ion batteries may become redundant. The availability and cost of different materials, particularly for cobalt, are experiencing significant volatility and affect battery prices, but also the content of batteries. Resource concerns and recycling challenges depend on what materials are used. The cost of virgin-material batteries and the technological development affect the profitability of re-usage and the demand for recycled material.

Barrier 3: Transport

Transport is another troublesome issue, as used LIBs can be considered to be hazardous waste. That means that transport is costly and highly regulated. Some logistics firms will not transport used LIBs, and air freight is not allowed at all. This is of course a problem for recycling as well as for second life. According to multiple respondents, transport is generally the most expensive part of battery recycling. This brings up the question of where markets are located – for EVs, for second-life solutions and for recycling. One respondent means that there might be a need for a global second-life LIB market, as for example there may be many EVs in Sweden but a low use for stationary electricity storage. The second-life batteries from Swedish EVs could be more valuable elsewhere.

Barrier 4: Outdated regulatory policy

As can be expected with emerging technologies, regulatory policy is lagging the energy storage technology that exists today. A statement from the Edison Electric Institute, an association that represents US investor-owned electric companies, summarizes the situation: “Many public policies and regulations must be updated to encourage the deployment of energy storage. Current policies were created before new forms of energy storage were developed, and they do not recognize the flexibility of storage systems or allow them a level playing field.” One regulatory construct that may need to change is to enable storage to be classified as generation, load or transmission and distribution infrastructure, so as optimize use of this “uniquely flexible resource.”

What are possible next steps to mitigate the risks associated with this business model and allow it to scale?

- Adoption Rate: In a scenario where battery supply from first life exceeds demand for second life battery applications, LG Chem can set up energy storage centers themselves and use the stored battery to meet surge demands or use it for energy trading with other traditional power companies. Passing of favorable regulations such as carbon credits can allow them to use the energy stored in their batteries as a hedging tool. Alternatively, locking in long-term pricing agreements with utility companies can offset the battery manufacturers from any unexpected price fluctuations.

- Technological advancements: While frequent changes to battery chemistries can adversely affect the business model as it would make it complicated for the battery makers to track and standardize the batteries to gain maximum effectiveness. However, despite substantial investments in battery design, most commercial battery chemistries are formulated based on the lithium-based design. Additionally, as mentioned above, offering more affordable batteries will actually provide the innovator with a competitive advantage as they will be able to maximize their returns at much lower costs.

- Transport: Transport of these hazardous waste over long distances is indeed a key issue that needs to be addressed. As sustainable adoption of clean technology demands reducing emissions wherever possible. Upon achieving economies of scale and a more widespread adoption, the battery manufacturers can have swap arrangements across geographies which can eliminate need for transporting the batteries over long distances. Furthermore, it must be understood that powering the road transport vehicles by renewables will limit the negative impact associated with transporting these batteries.

- Regulatory framework: Sustained involvement of concerned stakeholders is effective in getting governments to address concerns and pass legislation encouraging more sustainability. Additionally, several governments such as Norway, Denmark, Germany are pioneering with incentives to setup this business model and encourage circular adoption of the lithium ion battery.

What are the potentially negative social/environmental impacts of this business model?

- Increase in Lithium-ion Mining

Lithium-ion batteries are generally accepted as a cleaner alternative to using fossil fuels for energy. As we expect the demand for lithium-ion batteries to rise over the next years, the environmental impact of lithium-ion mining could become a bigger problem. Two main methods used today to extract lithium are 1) mining hard rock ores, and 2) extracting lithium from brine.

Producing lithium from hard rock ores involves using chemicals and high temperatures to separate the lithium from the rest of the rock. This process involves clearing land, digging mines, and storing waste rock, leading to changes in the environmental landscape and an increase in pollution.

Extracting lithium from brine water is relatively cheaper, more effective, and believed to be more ‘environmentally-friendly.’ In this process, a naturally occurring solution of lithium (mixed with other salts containing sodium, magnesium, and potassium) is pumped out of the ground and put in large ponds where it is left to evaporate excess water and separate from other salts for several months. However, the extraction of lithium-containing brine severely impacts the water supply – it uses approximately 500,000 gallons of water per ton of lithium. In Chile’s Salar de Atacama (Chile holds over half of the world’s known lithium reserves), mining activities consumed 65% of the region’s water. This takes away precious resources from local farmers who need water to cultivate crops and livestock. Locals have also claimed that lithium mining have contaminated the streams used by humans and livestock, and for crop irrigation.

Like any mining process, lithium-ion mining is still invasive, scars the landscape, destroys the water table, and pollutes the earth. Discovering a more sustainable method of extracting lithium still remains to be a major challenge for clean energy.

- Child Labor

Much of the cobalt used in lithium-ion batteries comes from countries, such as the Democratic Republic of Congo (DRC), where child labor still occurs in informal mines (i.e. small-scale operations in local communities). More than half of the world’s supply of cobalt comes from the DRC, and about 20% of exported cobalt is mined by hand in unregulated mines, often with child labor and dangerous conditions.

Many large companies buy cobalt directly from dealers, where there is no due diligence in place to verify how the cobalt is extracted, handled, transported, and traded. There is still a clear gap when it comes to multinationals and home states playing a meaningful role and requiring greater transparency around cobalt supply chain practices. Currently, no country legally requires companies to publicly report on their cobalt supply chain.

- Delay in recycling of battery components:

By delaying the need for recycling lithium ion batteries, several experts feel that this approach disincentivizes investment in recycling which they believe is the key in transitioning the consumption of lithium battery from a take-make and dispose model to a completely circular one. And the delay in recycling need simply increases the duration of the battery consumption but does not fundamentally address the need to get back the metals to reproduce fresh batteries.

On the whole, this approach is innovative and addresses some of the major concerns with adopting green technology. By adopting a simultaneous application use, this business model incentivizes transformation across a wider range of sectors, offering opportunities for creating and adopting sustainable initiatives at a local and national level.

Sources:

[1]Circular Business Models for Extended EV Battery Life Linda Olsson *, Sara Fallahi , Maria Schnurr, Derek Diener and Patricia van Loon, 2 November 2018

[5]https://www.wired.co.uk/article/lithium-batteries-environment-impact

[6]http://theconversation.com/politically-charged-do-you-know-where-your-batteries-come-from-80886

[8]Amnesty International 2016, This is What We Die For

Very interesting idea!!

One question, would this require a change in battery chemistry since as per my understanding, the automotive industry is focusing more on high power batteries whereas storage applications require more energy-dense batteries?

Very interesting innovation! Think it’s a great way to use lithium ion batteries more effectively, and good to hear that governments are stepping in to help push this idea forward.