Insurance companies are uniquely exposed to climate change risks. In an industry where business models entirely rely on some of the most complex quantitative risk assessment models, assessing a great number of variables behind every insurance policy, how will it adjust its predictions to possible causes of climate change, many of which are not yet known?

Key risks posed by climate change

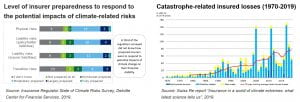

While difficult to accurately predict scale and timing, some physical risks resulting from climate change are clear. Increasing frequency and severity of extreme weather events and natural catastrophes drive significant insurance claims – in 2012, hurricane Sandy alone created economic losses of more than $70bn, of which majority was flood-related. Interestingly, less than 40% was insured. While such events drive material increases in demand for insurance, premiums need to be adjusted according to the insurance company’s risk of facing ballooning property reconstruction costs. Long-term, rising temperatures, and hence sea levels, will further damage homes and industrial facilities, particularly in low-lying lands. In addition to many other affected industries, agriculture will undoubtedly suffer. Rising temperatures contribute to faster growth of many crops, however the resulting limitation on maturing time overall leads to global yield reductions – a revenue loss that crop insurance providers will have to account for. With many agricultural policies being partly subsidized by governments, insurance companies will be dependent on the agricultural protection means of the state. Furthermore, the global gap between total losses and insured losses is wide and growing. The research arm of Swiss Re estimates that it more than doubled in real terms between 2000 and 2018, to $1.2trn, according to the Economist. Nine out of ten American homeowners are not insured against water floodings, despite half of the population living near water.

New business models in response to climate issues are evolving like never before. These unprecedented technologies bring transition risk to the insurers. As an example, several electric urban air mobility projects are well under way, in order to reduce pollution as well as congestion (e.g. Lilium and Uber Elevate). No historical data on safety and incident prevalence of eVTOLs challenges prevailing risk management and policy premium-setting.

As for investment risk, insurance companies are long-term investors and therefore need to increasingly monitor and respond to climate change effects of their portfolio companies. Not only is the impact on financial value of the investments relevant – insurance companies experience increasing pressure to also invest sustainably, which rules out potential positive-return investments in organizations that are profitable despite their climate-damaging nature.

Risk mitigation

Swiss Re is a reinsurance company based in Zurich and is the world’s second largest reinsurer. Swiss Re is also among the first insurance companies to have committed to transitioning their investment portfolios to net zero greenhouse gas emissions by 2050 and is at the forefront of climate change policies and regulations. In response to increasing risks due to climate change, Swiss Re has set out a number of initiatives across each of the three areas of risk.

The first type of initiative addresses physical risk: Swiss Re has been working on expanding its knowledge and capabilities in understanding climate change and the impact on their business in order to mitigate physical risk. This goes has been done through direct work with academic institutions and the leverage of advanced predictive models (for relevant risks posed by natural catastrophes such as cyclones, floods, wind storms etc.). Swiss Re has a dedicated internal property risk modelling team leading this effort. They also have their own independent institute which regularly publishes reports on sustainability topics such as climate change and third-world countries, among others. This institute gives them legitimacy in having a voice in the climate change discussion. Through extended research and understanding of the situation, Swiss Re can decrease the information risk and make decisions based on more accurate data.

In response to the transition risk, Swiss Re has established several initiatives such as a monitoring system as well as the establishing of new underwriting guidelines that assess and regulate incoming and existing business for risk exposure using set limits and triggers. Any instances that sit outside the guidelines are reviewed, discussed and documented in the underwriting file. As an example, in 2017, Swiss Re was among the early movers in the insurance space to withdraw coverage of any type of coal project. Although insurers have a clear financial self-interest to no longer insure coal since it improves their creditworthiness, this type of policy sets the path for newer ways to offer insurance and encourage cleaner energies across all industries. Swiss Re detects and addresses sustainability risks in its underwriting and investment transactions using its Sustainability Risk Framework that reflects the updated scientific knowledge and internal standards. This leads to a higher bar for screening incoming business, or in some cases prevents Swiss Re from offering insurance to ventures or companies that are at odds with the framework (e.g., offshore drilling in the Arctic oil sands, fracking and shale oil). In 2018, Swiss Re introduced a policy into its Sustainability Risk Framework, to limit its exposure to thermal coal utilities or mining to 30%. This is part of a larger initiative to steer carbon risks and manage its carbon intensity and corresponding risks.

Finally, to address investment risks, Swiss Re makes use of its Sustainability Risk Framework to assess its investment portfolio for risk to the environment and its operations. In 2017 Swiss Re also introduced new benchmarks with higher Environmental, Social and Governance (ESG)-rated companies for its active listed equity and credit portfolios. Swiss Re also reviews its portfolio for its carbon footprint and monitors and makes adjustments to internal policies as needed. They recently stopped investing in companies operating in the coal and tar sands space that are above set thresholds.

Swiss Re is actively tracking its own carbon footprint, ensuring transparent annual emissions reporting. It is also an active advocate of a worldwide policy framework for climate change through dialogue with clients, employees and the public sector.

Additional opportunities for risk mitigation

We believe that in addition to the initiatives mentioned above, Swiss Re could have an even greater impact in mitigating the risk of climate change on its business in three ways.

With greater developments on advanced analytics and machine learning on the horizon, Swiss Re should ensure it develops and renews capabilities to augment climate change models with big data/social media information for more robust risk assessment considerations. It should also ensure its organization is well placed to integrate these insights into business decisions in an agile manner. Swiss Re has a very strong institute already but can further its efforts in knowledge through the implementation of better tools and predicting models.

Secondly, Swiss Re can deepen its support for the energy and economy transition. The primary lever here would be to provide incentives in the form of discounted premiums to companies and policyholders who invest in mitigating climate-related risks. This can be done through the influence of government, for example, a tax rebate for insurers who are taking on greener clients or other actions.

Finally, Swiss Re can work directly with policymakers to develop preventive and adaptive public policies supporting a climate-resilient infrastructure (e.g., reinforce and/or discourage development in high-risk zones). This could contribute to lower physical risks as well as transition risks : through better initial infrastructure investments, governments can insure against too high costs if a natural catastrophe arises. This would pool risks between governments and insurers even further and would be more effective in the long run than premium increases which can increase the risk of growth of the uninsured.

Con clusion

clusion

The insurance industry is at the forefront of risks posed by climate change given how embedded it is across geographies and sectors and its closeness to any type of risk. Players like Swiss Re have been strong advocates of taking actions to mitigate their exposure to these risks. There is opportunity to further reduce ri

sk through three avenues: business decisions supported by insights from advanced analytics of climate patterns, increased incentives to support the energy and economy transition, and proactive policy development for climate-resilient infrastructure. Insurance companies will need to reinvent themselves in order to keep offering affordable insurance to consumers and businesses while still protecting from risks: if the industry does not adapt fast enough, large parts of the economy and of the world might become uninsurable.

Nice reading about the (re)insurance sector and how it will be impacted by climate change. The business model and policy pricing inherently will have to change as catastrophes become more common.

One thing I found interesting is that you didn’t mention how Swiss Re is working with its clients to push for lobbying and general industry shift towards insuring only sustainable activities. Swiss Re’s primary business is reassuring; thus many of its clients are insurers themselves. I think a strong network/partnership between the insurers and reinsurers can push for those policies supporting climate-resilient infrastructure.

Bianca B.